Advertisers tapping into retail media networks (RMNs) continue to struggle with performance, data, and metrics due to inconsistent methods, making comparisons across RMNs and other media platforms challenging.

These insights were published by the ANA in its second report titled **”Retail Media Network: Optimism Tempered with Caution.”**

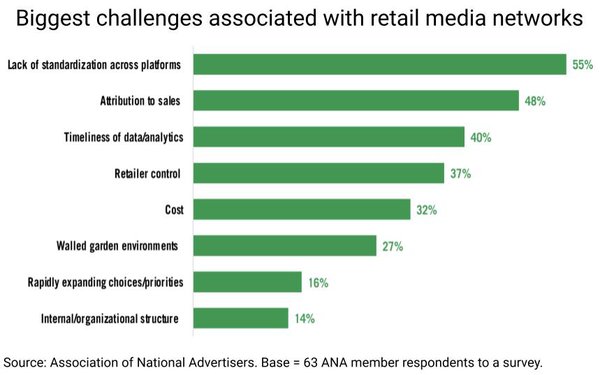

According to the report, 55% of marketers emphasize the need for RMNs to meet advertiser measurement standards, ranking this as the top challenge. This is followed by 48% citing attribution to sales and 40% highlighting the timeliness of data and analytics.

“The ANA getting involved with the MRC is a great move because they are all about measurement, standards, and accreditation,” said Bill Duggan, ANA group executive vice president. The ANA Media & Measurement Leadership Council (MMLC), led by the ANA’s Measurement for Marketers practice, is collaborating with the Media Rating Council (MRC) to develop a standardized list of measurements and processes for all RMNs. This list aims to facilitate accurate comparisons between various RMNs and may include metrics such as impressions, audience demographics, reach, and guidance for the timeliness of post-campaign data and analytics delivery.

While today’s focus remains on sales, 68% of marketers are already testing RMNs’ ability to influence mid- and upper-funnel objectives, such as brand awareness and consideration. This is one of the new findings from the report data, Duggan noted.

Safety remains a major concern with the growth of offsite ad targeting and Made for Advertising (MFA) site placements becoming more common among retail media buys.

Budgets allocated toward RMNs continue to grow. Data shows that 57% of marketers spend between 10% and 39% of their marketing budgets on retail media, up from 48% one year ago. Additionally, 62% expect to spend more in the next two years. The definition of RMN continues to evolve and expand, now including companies like United Airlines, Chase Bank, and PayPal, alongside traditional retailers like Target and Walmart.

“It’s an interesting evolution of the category,” Duggan said, noting the potential for companies to pull in data from frequent flyer or buyer memberships. “Don’t be surprised if you start seeing the same from American Airlines and others.”

The growth of RMNs may also be attributed to fear. Advertisers have felt pressure to participate in RMNs, thinking they may receive preferential treatment for shelf space and displays in physical locations. However, this ideology should diminish as the definition of RMNs continues to evolve. Nearly two-thirds of respondents still feel RMNs are a “have to buy” rather than a “want to buy” media type, with 63% suggesting retailers have a significant influence on a marketer’s decision to use various RMNs.