A total of 258,000 apps were downloaded per minute for all types of publishers in 2024 for iOS and Android operating systems — a 1% decline versus the prior year for iOS and Google Play stores, according to a new report released by Sensor Tower.

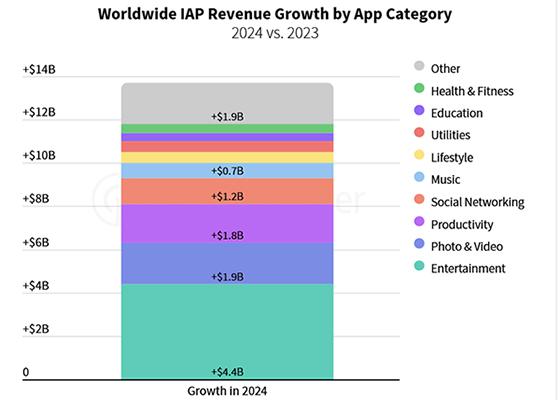

In-app purchase revenue rose 12.5% to $150 billion, and the number of apps used rose 9.2% to 26 per month for each user–a total of seven unique apps were used each day on average.

Sensor Tower’s Insights team compiled the download and in-app purchase (IAP) revenue estimates provided in the report using its technology.

The figures cited reflect iOS App Store and Google Play download and revenue estimates for January 1, 2014 through December 31, 2024.

Revenue growth included strong growth in top markets in North America and Europe, but the United States led the way with $52 billion in consumer spend.

With game revenue growth lagging that from non-games, some gaming-focused markets in Asia experienced more modest growth or even slight declines YoY.

Retail apps are going global. Overall, these apps have been regional with most of the biggest markets getting a large share of downloads from domestic publishers, according to a new report released by Sensor Tower.

Mainland China, Japan, and India are some examples of major markets with at least 70% of downloads coming from local-based publishers.

Globally, the United States leads with top apps like Amazon, and Temu, which is headquartered in the U.S., but its parent, PDD Holdings, is based in China.

Top U.S. retailers like Walmart and Target lead retail media and mobile app use, and use every opportunity to connect customers with the products they search for online. Mobile-first food delivery companies like Uber Eats and DoorDash have relatively high app use compared with traditional brick-and-mortar retailers. Pet stores lean heavily on retail media, but have yet to invest as much in boosting mobile app adoption.

This suggests that mobile could become an opportunity for retailers like Chewy and Petco to improve the consumer’s shopping experience and boost loyalty, according to the report.

Engagement trends for streaming media apps reveal a saturated market. Mobile streaming apps have seen continuous growth for in-app revenue and downloads, engagement continues to fall as users experience “digital fatigue.”

Macroeconomic pressure on consumer spending and competition from social apps have pushed limits as networks increasingly depend on live events like sports, as well as promotional content that centers on major events to retain users.

The absence of switching costs between streaming platforms also allows users to “churn” on and off the different networks based on programming, making it difficult for new and small platforms to drive loyalty and grow subscribers.

Excluding India, time spent on streaming apps was roughly the same in 2024 as it was the previous year. Time spent still declined in some of the highest-revenue markets, such as the U.S. and China.

The increase in-app purchase revenue may be partially attributed to consumers becoming more comfortable paying for these services on their mobile devices, even as they divided their time spent on their TVs, phones, and other devices.

Some of the biggest app subcategories last year still provide stable sources of new downloads for mobile app publishers — including social media, with apps like Instagram and TikTok; film & television, with streaming apps like Netflix and Disney+; and General Shopping apps like Amazon and Temu, which had modest positive YoY growth globally in 2024.

A few financial services subcategories also achieved positive growth, with digital wallet and P2P payment app downloads rising 10% and consumer banking app downloads up 2% YoY.

Software apps saw notable declines. Antivirus & VPN apps fell 32% YoY, and file management declined 24%.

Sensor Tower attributes a large portion of this decline to market corrections following years of rapid download growth, particularly in a few of the largest markets like India and Brazil.